Blog

Table of Contents

Opinions vary regarding the timing of the “Altseason” in the cryptocurrency market. Some assert that this bull market will skip the altseason, while others predict it will arrive next year. Another viewpoint suggests that it typically occurs about three months after a Bitcoin halving event, which historically has taken place around August. However, as of November, the arrival of the halving remains uncertain, leading to a mysterious Altcoin performance. Since the bull market encountered obstacles in March 2024, cryptocurrency analysts have observed a downward trend in the altcoin market. However, recent leading indicators suggest that the recent recovery could signify a future “large-scale movement,” with Bitcoin prices persistently reaching new highs. It appears that the “Altseason” is imminent.

What is Altseason?

Altseason refers to a period in the cryptocurrency market when the prices of multiple altcoins (cryptocurrencies other than Bitcoin) outperform Bitcoin for several weeks or months. With some technical analysis of past inverse seasons, it’s easy to see that alt seasons typically occur in the later stages of Bitcoin’s bull market. As the upward momentum of Bitcoin prices weakens, investors may seek higher yields and shift their funds to other altcoins. When the market is generally optimistic about altcoins and discussions on social media increase in heat, it may indicate that altseason is approaching. At this time, investors should closely monitor market dynamics to seize investment opportunities promptly.

How to Predict Altseason?

One way to predict the Altseason is by looking at historical data and measuring market sentiment indicators, for instance, the Altseason index and market cap BTC dominance chart, to get a sense of how over-bullish or bearish everyone else in the Alts coin market is. If these metrics indicate the positive market sentiment and a large majority of Altcoins outperform Bitcoin, you may interpret that as altseason is coming. Furthermore, a decrease in Bitcoin’s market capitalization within the entire cryptocurrency field (Bitcoin dominance) can also be understood as if other altcoins are increasing their share of the total volume. This is one more important signal for receiving Altseason. To analyze the price trends of an altcoin, investors can use technical indicators, based on moving averages or the Relative Strength Index (RSI) to gain clues about market trends and potential turning points.

Are Altcoins Ready to Rally?

Since the 2017 bull market cycle, the Altcoin market has demonstrated stability based on technical analysis, remaining above the upward trendline supporting TOTAL2 (which represents the total market capitalization of all cryptocurrencies excluding Bitcoin). Independent cryptocurrency analyst Mags announced in an X post on October 26th, “The market capitalization of altcoins is currently testing the long-term trendline support that has remained strong for the past eight years.” This retesting of the multi-year support line serves as a bullish signal, hinting at a potential easing of the downtrend. An increase in buying activity at current levels could propel altcoin prices upwards. The analyst further noted, “With Bitcoin’s surge, the market appears poised for significant volatility. The analyst added, “With Bitcoin’s explosion, the market looks ready for large-scale volatility.”

It’s Still Bitcoin Season

Some investors believe that Bitcoin is the cornerstone for the rise of altcoins. When Bitcoin’s price falls due to the very functionality that underpins it, all altcoins are affected, as Bitcoin lacks an independent market cycle and Bitcoin’s price primarily drives their correlation. When Bitcoin’s price increases, altcoin prices tend to follow suit, potentially attracting more attention due to market enthusiasm. Not all altcoins appreciate or reach new highs; only those stablecoins that maintain their value over the long term and stand the test of time have such potential.

Bitcoin Market Dominance. Source: TradingView

According to the Bitcoin dominance TradingView chart, the BTC dominance stands at 59.56% as of this article’s publication, showcasing an upward trajectory and aligning with the current Bitcoin market cycle, suggesting that it remains within a “Bitcoin season.” Some analysts believe there are some positive altcoin signals, and Bitcoin’s dominance may experience pressure, indicating a possible rebound for alternative coins. However, altcoin dominance has yet to be established.

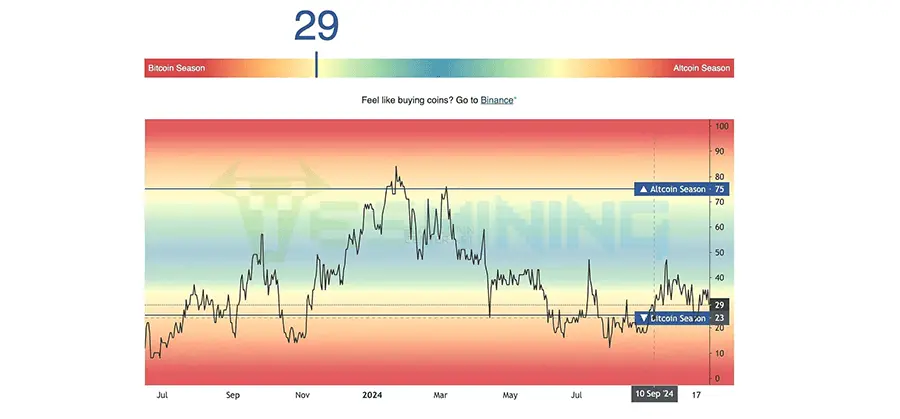

Altcoin season index. Source: Blockchain Center

The Altcoin season index, based on Blockchain Center data, reveals that only 29% of the top 50 altcoins have surpassed BTC’s performance in the last three months, significantly falling short of the 75% threshold needed to declare an official Alt Season.

Choose High-Profit Miner

Mining constitutes a significant topic of discussion when it comes to the market dynamics of Bitcoin and other cryptocurrencies. Selecting high-profit mining machines based on market trends is crucial.

There is a set of miners with advanced chip technology, high hashrate, and low energy consumption for efficient mining of Bitcoin and several Altcoins. These miners tear through reply hash calculations in the blink of an eye and thus give a better chance at winning a block reward jackpot. Regarding Bitcoin Miner, a few new models have recently caught the eyes of investors: Antminer S21e XP Hyd 3U, Antminer S21 XP Hyd, and Antminer S21 XP Immersion. In addition, if some have targeted ASIC miners for Altcoins, then the Antminer L9 16G/17G capacities and the Antminer AL1 15.5T/AL1 Pro 16.6T have been quite impressive in terms of profit returns. If you are an individual who wishes to get into mining, then market trends and the selection of the right rig will be two key factors that enable you to make your mark.

Conclusion

Investment risks remain high because of the high volatility of altcoins and many sudden changes in the cryptocurrency market. It is said that not every altcoin will keep on top, even when it is altseason. Generally, the short-term trading of altcoins is much better than the long-term holding. Even during the bull-market season, all altcoins never followed the same trend. Therefore, through Yesmining, keeping a close view of the altcoin updates takes you to the recent changes in the market and gives you great returns with some altcoins’ huge increases while diversifying your portfolio. Yesmining would like to remind everyone that there is risk involved in investing, and we need to upgrade ourselves with new information, expand research, and be very cautious when making any decisions.