Blog

Table of Contents

Merged mining in cryptocurrency lets miners get rewards from two blockchains at once. It is like doing one job but getting two paychecks. Miners use the same machines and power for both networks. This helps them make more money. It also helps smaller blockchains stay safe.

Merged Mining in Cryptocurrency

Simple Analogy

Merged mining is like getting two paychecks for one job. A miner uses one computer and the same energy. They solve puzzles for two blockchains at once. This lets them earn rewards from both networks. They do not need extra work. Think of a student who does one homework and gets credit in two classes. Miners get double rewards with the same resources.

Definition

Merged mining lets miners mine two coins with the same algorithm. They do not lose speed or need more machines. Miners send one proof of work, and both blockchains accept it. This helps miners make more money and keeps both networks safe. Litecoin and Dogecoin use the Scrypt algorithm. Miners can earn rewards from both coins at the same time. Merged mining uses the same computer power for both chains. This makes mining easy and helps miners earn more.

Parent and Auxiliary Chains

In merged mining, the parent chain is the main blockchain. Miners do their work there. The auxiliary chain is smaller and accepts proof of work from the parent chain. Both chains must use the same hash algorithm for merged mining. The table below shows hash algorithms and their coins:

Hash Algorithm | Associated Cryptocurrencies |

|---|---|

SHA-256 | |

Scrypt | Litecoin, Dogecoin |

The auxiliary chain must use the same hash algorithm as the parent chain.

Miners use the same computer power for both chains.

Special rules help the chains share work and talk to each other.

Merged mining helps both blockchains stay safe and work better.

How Merge Mining Works

AuxPoW Process

To understand how merge mining works, it helps to look at the steps miners follow. Miners use a process called auxiliary proof of work. This process lets them mine two blockchains at the same time. The parent chain, like Bitcoin, handles the main mining work. The auxiliary chain, such as Namecoin or Dogecoin, accepts the proof of work from the parent chain.

When a miner starts, they collect transactions for both blockchains. The miner creates a block for the parent chain and a block for the auxiliary chain. The auxiliary block includes a special link to the parent block. This link appears in the coinbase transaction of the parent block. If the miner finds a valid hash for the parent chain, they can submit this proof to both chains. The auxiliary chain checks the parent block’s data to confirm the work.

In merged mining, blocks appear on both the parent and auxiliary chains when the parent chain hash is solved. The auxiliary chain only produces a block if its own hash is solved. The parent chain’s data in the auxiliary block helps validate the proof of work, keeping the network efficient.

Here is a simple list of how merge mining works in practice:

The parent block includes a special transaction that points to the auxiliary block’s hash.

When the miner finds a valid hash, they submit it to both chains.

The auxiliary chain checks the parent block to confirm the work.

Both chains can reward the miner if the proof is valid.

This process allows miners to secure two blockchains at once. They do not need extra energy or hardware.

Algorithm Requirements

For merged mining to work, both the parent and auxiliary chains must use the same mining algorithm. For example, Bitcoin and Namecoin both use SHA-256. Litecoin and Dogecoin both use Scrypt. If the algorithms do not match, merged mining cannot happen.

Merged mining only works when all coins use the same algorithm.

The auxiliary proof of work process depends on this compatibility.

Miners can use the same hardware and software for both chains.

Tip: Before starting merged mining, always check if the coins share the same algorithm. This step saves time and avoids setup problems.

Understanding how merge mining works helps miners choose the right coins and tools. When the algorithms match, miners can earn rewards from two blockchains with the same effort.

Benefits of Merged Mining

Double Rewards

Merged mining lets miners earn more money. They can get rewards from two blockchains at once. Miners do not have to pick just one coin. They get extra money for the same work.

Miners get rewards from both the parent and auxiliary chains.

They earn more rewards without doing more work.

Both coins get more use and are easier to trade.

This setup makes more people want to mine. It helps both blockchains become stronger.

No Extra Energy

Merged mining does not use more energy than mining one coin. Miners use one proof-of-work to keep both blockchains safe.

They check transactions and make new blocks for both chains with the same hardware.

There is no need for more machines or power.

This way is efficient and can even use less energy than mining each coin alone.

Merged mining lets miners help more than one network without higher electricity bills.

Security for Small Chains

Small blockchains can have security problems. Merged mining helps them by sharing the strong hash power of a bigger chain.

Dogecoin got safer after it started merged mining with Litecoin.

The Rootstock sidechain uses Bitcoin’s hash power to stay safe.

When more miners join, the network is harder to attack. Rewards from both chains bring in more miners, making the system even safer.

Risks and Challenges of Merged Mining in Cryptocurrency

Setup Complexity

Setting up merged mining is hard for both new and skilled miners. They face tough technical problems that make it less popular. The table below lists some common problems and what they cause:

Technical Challenge | Impact on Adoption Rates |

|---|---|

Block Validation Challenges | Makes things harder, so fewer miners want to try it. |

Work Reuse Issues | Can cause security problems, so people may not trust the system. |

Malleability Enables Denial-of-Service Attacks | Uses up network resources, which can make miners quit. |

Unlimited Block Size Escalates to Double-Spend | Costs more for node operators, so they may not want to use merged mining. |

Miners need to learn new programs and keep their systems working right. This takes time and can make merged mining less liked, especially after rewards go down from a halving.

Auxiliary Coin Volatility

Auxiliary coins like Dogecoin can change price a lot. This makes how much money miners get go up and down.

The prices of auxiliary coins can go up or down fast, so miners may earn more or less.

Miners might switch to other coins if those pay better right now.

Miners also think about how much Litecoin will be worth later when they choose what to mine.

When a halving happens, rewards get smaller. If miners do not make enough, they may stop mining the auxiliary chain, which makes it less safe.

Centralization Concerns

Merged mining can make a few miners very powerful. These miners can control most of the network. The table below shows the risks:

Mining Method | Centralization Risk |

|---|---|

Proof of Capacity (PoC) | Can have storage centralization, but more people can join to help. |

Proof of Work (PoW) | Big miners can take over, so there is a high risk. |

In PoW, big miners often win and control things. After a halving, even fewer miners may stay, so centralization gets worse.

Our study adds to what we know by showing there are many ways to look at centralization. We found different types and made a list of centralization concerns.

Security Debates

Some people think merged mining is not as safe as it seems. If one big group controls the auxiliary chain, it could attack the network. Others say higher rewards after halving bring in more miners, so attacks are harder. Miners may not want to risk their main chain rewards, but they might act differently on smaller chains. People still talk about security as networks grow and rewards change after halvings.

Supported Coins and Pools

Popular Pairs

Many cryptocurrencies let miners do merged mining. Some pairs are popular because they use the same mining algorithm. The table below lists common pairs and their main features:

Cryptocurrency Pair | Description |

|---|---|

Namecoin and Bitcoin | First coin to support merged mining, focused on decentralized domain names. |

Merged to enhance security, both use the Scrypt algorithm. | |

Rootstock (RSK) and Bitcoin | Uses Bitcoin’s network for its smart contract platform. |

Elastos and Bitcoin | Focused on building a secure internet. |

Syscoin and Bitcoin | Combines blockchain and e-commerce, also uses SHA-256. |

Dogecoin and Litecoin are special because they use Scrypt. Namecoin was first to do merged mining with Bitcoin. Rootstock and Elastos use Bitcoin’s network to make their platforms stronger.

Pool Support

Mining pools help miners work together and share rewards. Pools let miners join forces and split what they earn. How a pool pays out can change how much money a miner gets. Here are some common ways pools pay:

Pay Per Share (PPS): Miners get paid for every share they send in. This way gives steady payouts.

Pay Per Last N Shares (PPLNS): Rewards depend on how many shares a miner sends during a set time. Payouts can go up or down.

Maxpool is more than just a mining pool. It is smarter and helps all miners do better. Maxpool makes mining easy, fair, and open. It helps miners of any size earn more and improve their work.

Picking the right pool and payment method helps miners earn more from merged mining.

Shared Algorithm

Merged mining works only if coins use the same algorithm. For example, Dogecoin and Litecoin both use Scrypt. Bitcoin and Namecoin use SHA-256. This lets miners use the same machines for both coins. Miners should always check the algorithm before they start merged mining. This step helps stop problems and keeps mining simple.

Step-by-Step Guide to Setting Up Merged Mining for Multiple Cryptocurrencies

Choose the Compatible Coins

A miner needs to pick two coins that work with merged mining.

Pick a main coin and an auxiliary coin.

Both coins must use the same hashing algorithm, like SHA-256 or Scrypt.

Make sure your mining hardware works with both coins.

Good pairs are Bitcoin and Namecoin or Litecoin and Dogecoin.

Select a Reliable Merged Mining Pool

A strong mining pool makes things easier and safer.

Criteria | Description |

|---|---|

Security Measures | Pools should use strong security, like two-factor authentication. |

Pool Size | Big pools solve more blocks but pay less per miner. |

Uptime | High uptime means mining does not stop often. |

Payout Methods | |

Fee Structures | Lower fees are good, but trust is more important than just low costs. |

Tip: Pick a pool with servers near you for better speed.

Install and Configure the Software for Multiple Coins

Download mining software that works with merged mining for your coins.

Follow the pool’s setup steps.

Enter the right settings for each chain.

Update your software often to keep it safe.

Set Up Secure Wallets for Each Cryptocurrency

You need a wallet for each chain.

Turn on multi-signature for more safety.

Back up your private keys and wallet files.

Only get wallets from official websites.

Start the Merged Mining Process

Start mining by linking your setup to the pool.

The mining software sends proof of work to both chains.

The pool splits up rewards for each chain.

Monitor Mining Performance and Optimize Rewards

Watch your mining setup using important numbers.

Metric/Strategy | Description |

|---|---|

Total Quarterly Hashrate | Shows how strong your mining setup is. |

Pool Participation | Tells how many pools help keep each chain safe. |

Mining Difficulty Adjustments | Changes how hard it is to mine each chain. |

Market Dynamics | Coin prices can change how much you earn. |

Check your setup often and change settings to get the best rewards from each chain.

Which Coins Support Merged Mining?

Dogecoin and Litecoin

Dogecoin and Litecoin are the most popular for merged mining. Both coins use the Scrypt algorithm. Miners can work on both networks at the same time. This lets them earn rewards from both coins with one mining job. Many miners pick these coins to make more money without using extra energy. Merged mining raises the hash rate for both coins. This makes each network safer. Other coins also let miners do merged mining. Namecoin, Elastos, and Syscoin are examples. New coins join as projects want better security and more miners.

Namecoin: First coin to do merged mining with Bitcoin.

Dogecoin + Litecoin: Miners can earn DOGE and LTC together.

Elastos: Lets miners do merged mining with Bitcoin.

Syscoin: Uses SHA-256 and works with Bitcoin for merged mining.

Merged mining helps coins get stronger by sharing rewards and security.

Next-Generation Mining Hardware Recommendations

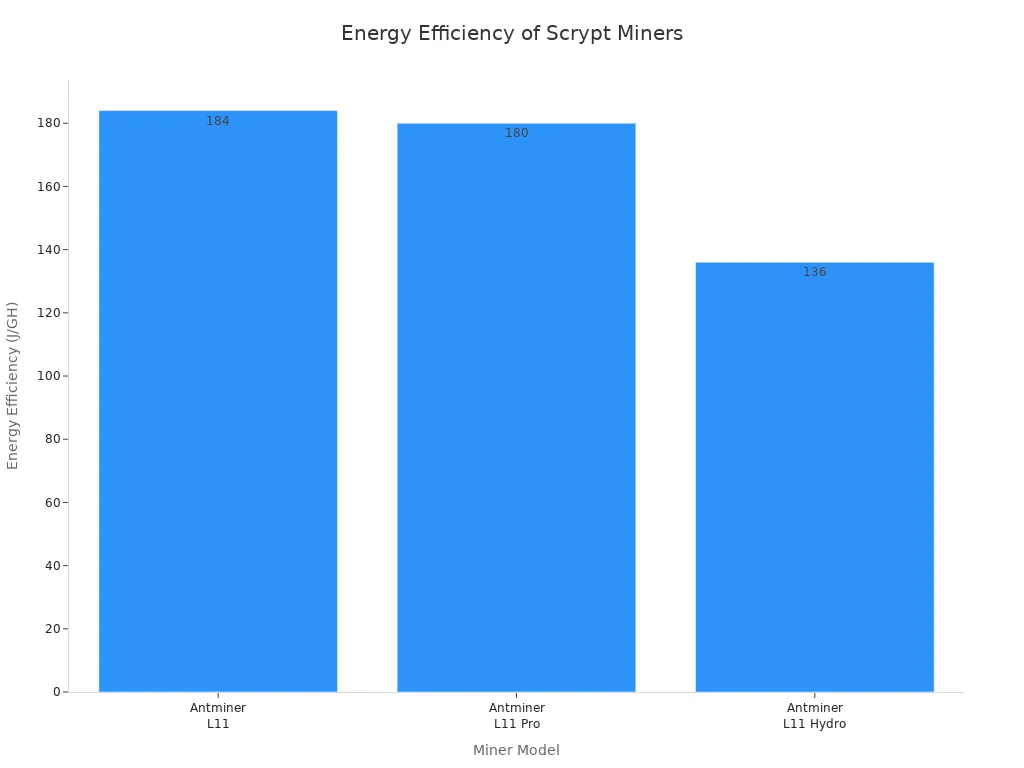

Miners who want to mine Scrypt coins like Dogecoin and Litecoin need strong machines. New mining hardware gives high hashrates and uses less energy. The table below shows top choices for merged mining these coins:

Model | Hashrate | Power Consumption | Energy Efficiency | Cooling Type | Noise Level |

|---|---|---|---|---|---|

Antminer L11 | 20 GH/s | approx. 3,680 W | approx. 184 J/GH | Air Cooling | approx. 75 dB |

Antminer L11 Pro | 21 GH/s | approx. 3,800 W | approx. 180 J/GH | Air Cooling | approx. 75 dB |

Antminer L11 Hydro | 33 GH/s | approx. 4,500 W | approx. 136 J/GH | Water Cooling | approx. 70 dB |

Picking the right machine helps miners get more from merged mining. Efficient hardware lowers electricity bills and helps miners earn more.

Will It Stay Profitable?

Merged mining profits depend on many things. Coin prices can change fast. Miners need to watch prices and use tools to lower risks. Mining gets harder when more miners join. This means earning coins is tougher. Buying new machines costs a lot. Electricity prices also change how much miners make each day. The value of mined coins affects profits. More coins now support merged mining, so there is more competition. Miners must keep upgrading their machines. Careful planning and checking help miners stay profitable as merged mining changes.

How Does Merge Mining Compare to Dual Mining?

Merged mining and dual mining help miners earn more coins. Both let miners get rewards from more than one cryptocurrency. But they work in different ways. Merged mining uses one algorithm for two coins. Miners use the same hardware and energy for both blockchains. This keeps costs low. It does not make machines work harder.

Dual mining is not the same. Miners use two algorithms to mine two coins. They need more energy and stronger hardware. Dual mining makes machines work harder. It uses more electricity. Miners pay higher bills and their equipment wears out faster.

Miners who pick dual mining must check if their machines can handle extra work. They also need to watch for higher energy use.

Here is a table that shows how merged mining and dual mining are different:

Feature | Merged Mining | Dual Mining |

|---|---|---|

Algorithms Used | One algorithm for two coins | Two different algorithms |

Energy Consumption | No extra energy cost | Increased energy consumption |

Hardware Stress | Minimal hardware stress | More demanding on hardware |

Example | Bitcoin and Namecoin (SHA-256) | Ethereum (Ethash) and TON (Blake2b) |

Miners using merged mining get rewards from two blockchains with less work. Dual mining gives rewards from two coins, but needs more power and better machines. Dual mining is harder for beginners. It needs more setup and checking. Merged mining is easier for saving energy and keeping machines safe.

Merged mining uses one proof of work for two coins.

Dual mining needs separate setups for each coin.

Dual mining can cost more and have more problems.

Both ways help miners earn more. Merged mining is usually more efficient. Dual mining is good for those who want to try different coins, but they must be ready for extra work.

Merged mining lets miners earn extra rewards without more work.

This way helps small blockchains be safer from attacks.

When bitcoin halving happens, merged mining can help miners make up for lost profits.

Many experts think merged mining is a good idea for both new and skilled miners who want to earn as much as possible.

FAQ

What is the main benefit of merged mining?

Merged mining lets miners earn rewards from two blockchains at the same time. They use the same hardware and energy for both networks.

Do miners need special equipment for merged mining?

Miners do not need special equipment. They use the same machines as regular mining. Mining pools often support merged mining for easier setup.

Can merged mining make small blockchains safer?

Yes. Merged mining increases the hash power on small blockchains. This extra security helps protect against attacks.