Blog

Table of Contents

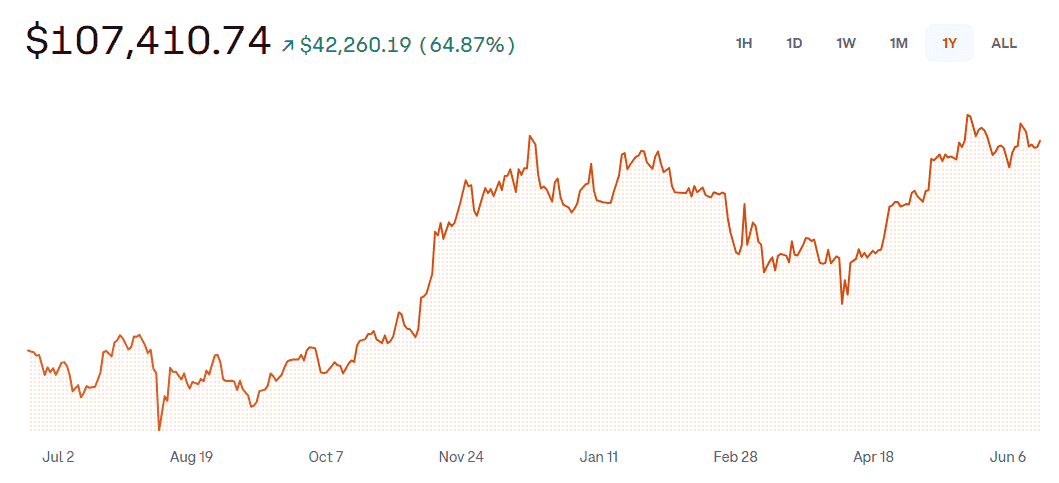

Background: Recent Bitcoin Price Movements

As the world’s largest cryptocurrency by market capitalization, Bitcoin has been on a historic rollercoaster ride. On December 4, 2024, fueled by optimism following Donald Trump’s U.S. presidential election victory, BTC finally shattered the long-anticipated $100,000 barrier – a monumental milestone. Yet this euphoria proved short-lived. By mid-April 2025, Bitcoin had retreated dramatically, sinking back to pre-election levels.

Volatility remains Bitcoin’s signature trait. Just as market sentiment turned cautious, a May 8, 2025 surge propelled BTC past $100,000 again – this time driven by breaking news of a landmark U.S.-UK tariff agreement.

This volatility continued into early 2025 when Bitcoin briefly soared past $70,000 before facing significant corrections. For the world’s most established cryptocurrency, such wild price swings have become routine. Against this backdrop of turbulence, investors worldwide are asking:

Is Bitcoin still a viable investment in 2025?

Key Factors That Influence Bitcoin Price

1, Competition in the Crypto Market

Bitcoin is often viewed as the “gold standard” of the crypto market, — it was the first and it’s still the most well-known. But let’s be real: it’s not the only player in the game anymore.

Ethereum (ETH) brings a whole different level of functionality with smart contracts — that means it’s not just a digital coin, but a platform people can build stuff on.

Then we found that other fast, scalable Layer-1 blockchains like Solana and Avalanche are competing for market share, while stablecoins (e.g., USDT, USDC) and CBDCs emerge as alternatives for payments and value storage.

So what happens? When investors see higher potential returns or fresh innovation in other crypto projects, they may move their money out of Bitcoin for a while. That shift in capital can pull Bitcoin’s price down temporarily, even if the long-term outlook stays strong.

2, What Made Bitcoin Value

One of the biggest things driving Bitcoin’s price is simple economics: supply and demand.

Limited Supply: Bitcoin is designed with a limited supply of 21 million. That’s built into the code. That limited supply makes it more valuable—seem like digital gold. When more people want Bitcoin—whether from everyday investors, big institutions, or massive holders (aka whales)—the price tends to rise. More demand, same supply = higher prices.

Bitcoin is also decentralized, its proof-of-work blockchain ensures data integrity, and it’s incredibly tough to hack. This decentralized nature adds to its appeal as a store of value and a reliable asset.

Also, we have to know: what is the halving of Bitcoin? Every four years or so, something called a “halving” happens. This means fewer new Bitcoins are created (mined), so supply slows down even more. In the past, we’ve seen prices rise after each halving—like in 2012, 2016, and 2020. Will 2025 be the same story? Many investors think so.

3, Bitcoin’s Protocol and Predictability

What makes Bitcoin stand out? It’s simple—no middlemen, no central banks, and zero government interference. Unlike traditional currencies, Bitcoin sticks to a fixed reward system, and with each halving event, the supply of new BTC slows down even more. That’s why many investors see it as a solid store of value—scarce, reliable, and designed for the long run.

Bitcoin was designed as an alternative to fiat currencies. It offers a way to transfer value globally without banks or government control. This level of transparency and decentralization has earned it a strong trust from long-term crypto investors.

4, Market Sentiment and Investor Psychology

The Crypto Fear and Greed Index, whale wallet activity, and spikes in trading volume can impact the crypto market and investor decisions.

- Bullish news(ETF approval, adoption by companies, halving cycle) drives FOMO (Fear of Missing Out).

- Bearish news(regulation crackdowns, exchange failures, hacks) causes FUD (Fear, Uncertainty, Doubt).

*The Crypto Fear and Greed Index: Binance.com

5, Social Media and Influencer Impact

Platforms like Twitter/X, YouTube, Reddit, and TikTok are driving the crypto market. Their influence is real and powerful.

Big-name influencers like Elon Musk, Michael Saylor, or popular crypto YouTubers can shake up Bitcoin’s price with just a single tweet or video. Sometimes, Elon Musk’s X post about Bitcoin may spark the buying frenzy among miners.

And as crazy as it sounds — meme culture, viral narratives, and top reddit bitcoin community hype do play a role in determining Bitcoin prices. These short-term coin price changes often have more to do with emotions and buzz than actual fundamentals. In the cryptocurrency world, that’s part of the game strategy.

Is it Worth Mining Bitcoin in 2025? Who Should Do It?

These market dynamics underscore Bitcoin’s core value proposition: decentralization and scarcity. Yet as we shift focus to mining, a critical tension emerges. As Bitcoin mining grows more computationally intensive and network congestion increases, the hardware requirements (and associated power demands) escalate exponentially. This isn’t just about profitability; it’s reshaping participation itself. Rising costs for cutting-edge ASICs and energy infrastructure increasingly marginalize smaller miners, potentially concentrating control among industrial-scale operations. Such centralization risks undermining the very decentralized ethos that defines blockchain technology. So who can still viably mine Bitcoin in 2025—and should you?

For investors seeking long-term passive income, or those have low electricity costs or renewable energy, Bitcoin mining can still be a good choice. But for miners should face the real challenge for miners is choosing the right btc mining rig that helps you maximize efficiency and reduce costs. Yesmining recommends these 4 Bitcoin mining rigs:

- Avalon Q– The Avalon Q Bitcoin miner, designed by Canaan, is the latest model for solo mining at home. It offers a quiet mining experience while delivering impressive performance. With a hashrate of up to 90 TH/s, it stands out as one of the top miners for solo Bitcoin mining. For more reviews of Avalon models, you can refer to our another Blog How to Mine 3.125 Bitcoin At Home.

- Antminer S21Hydro 335T – For the SHA-256 algorithm, it has an impressive hash rate of up to 335TH/s, one of the fastest hash rates compared to similar Antminers.

- Bitmain Antminer L9–Designed for Litecoin/Dogecoin mining, the L9 series has remained a popular choice among miners since its release.

- MicroBT WhatsMiners series– Stable, powerful, great for professional miners.

Conclusion

Bitcoin remains a strong investment consideration in 2025. Its long-term value lies in scarcity, decentralization, and real-world adoption. Whether buying BTC directly or mining it, both approaches offer unique opportunities. Yesmining would like to remind all investors: always pay attention to market trends, respond flexibly to changes. Keeping in mind wise investment decisions and choosing the strategy that best suits you based on your risk appetite, technical familiarity, and investment horizon.

FAQs

Is Bitcoin still profitable in 2025?

Yes, particularly with long-term holding or cost-effective mining strategies.

Is it too late to invest in Bitcoin?

Not necessarily—many believe we’re still early in global adoption.

How much should I invest in BTC as a beginner?

Start small, consider dollar-cost averaging, and never invest what you can’t afford to lose.

Will Bitcoin go up again?

Historically, Bitcoin has rebounded after major corrections. Long-term growth drivers like scarcity, halving cycles, and institutional adoption suggest upside potential, though regulatory shifts could impact short-term trends.