Blog

Grayscale Research Predicts: Will the Current Crypto Bull Market Extend to 2025?

Table of Contents

Grayscale Research, an authority in cryptocurrency market analysis, has released a report titled “The State of the Crypto Cycle,” suggesting that the current crypto bull market could be influenced by new developments, such as the launch of spot Bitcoin and Ether exchange-traded products (ETPs) and evolving macroeconomic conditions. These factors may cause the market to deviate from the traditional four-year cycle, potentially extending the bull run into 2025 and beyond.

Understanding the Four-Year Cycle of Crypto Valuations

Historically, cryptocurrency markets have followed a clear four-year cycle, alternating between phases of price appreciation and depreciation. Grayscale notes that investors can track this cycle using blockchain-based indicators to make informed decisions on risk management. According to their research, the market is currently in the mid-cycle phase.

Blockchain Indicators: Measuring the Maturity of Bitcoin’s Bull Market

Investors can use various blockchain-based metrics to determine the maturity of the bitcoin bull market. While these indicators can only provide a rough comparison between the current price appreciation phase and past performance, and cannot guarantee that the relationship between these indicators and future price returns will mirror previous cycles, overall, the key metrics in the Bitcoin cycle remain below the levels seen at past price peaks. This suggests that, if supported by fundamentals, including increased adoption of cryptocurrency applications and favorable macroeconomic factors, the current bull market could continue.

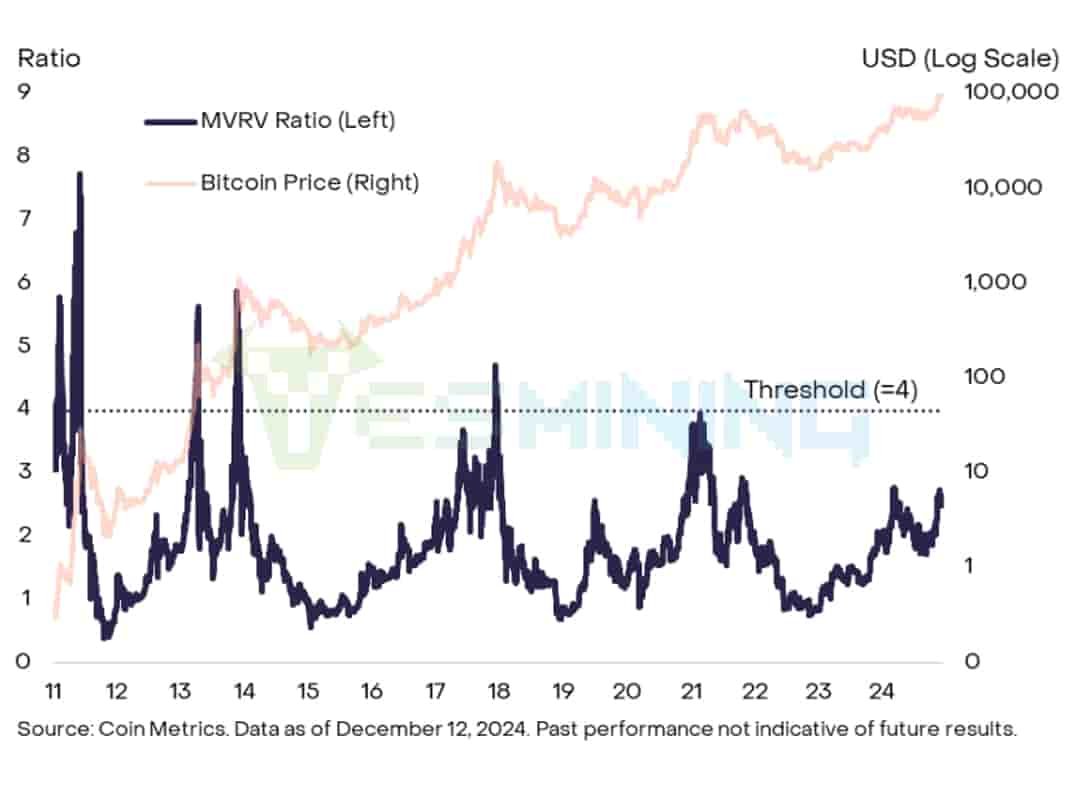

1,MVRV Ratio: This ratio measures Bitcoin’s market value relative to its realized value. Currently, at 2.6, it’s still below previous cycle peaks, indicating potential for further price growth.,

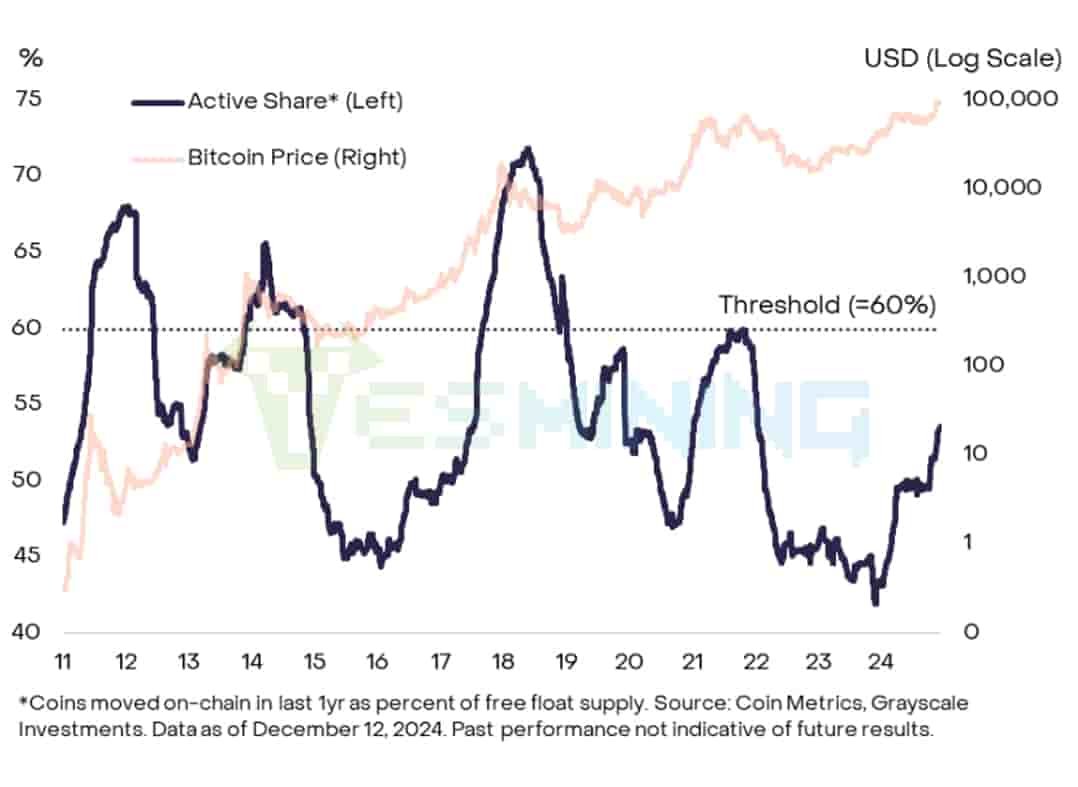

2,HODL Waves: This tracks the proportion of Bitcoin’s circulating supply that has been traded in the last year. Currently, around 54% has been traded, which is lower than the 60% seen in previous cycles, indicating that a significant portion of Bitcoin remains held long-term.

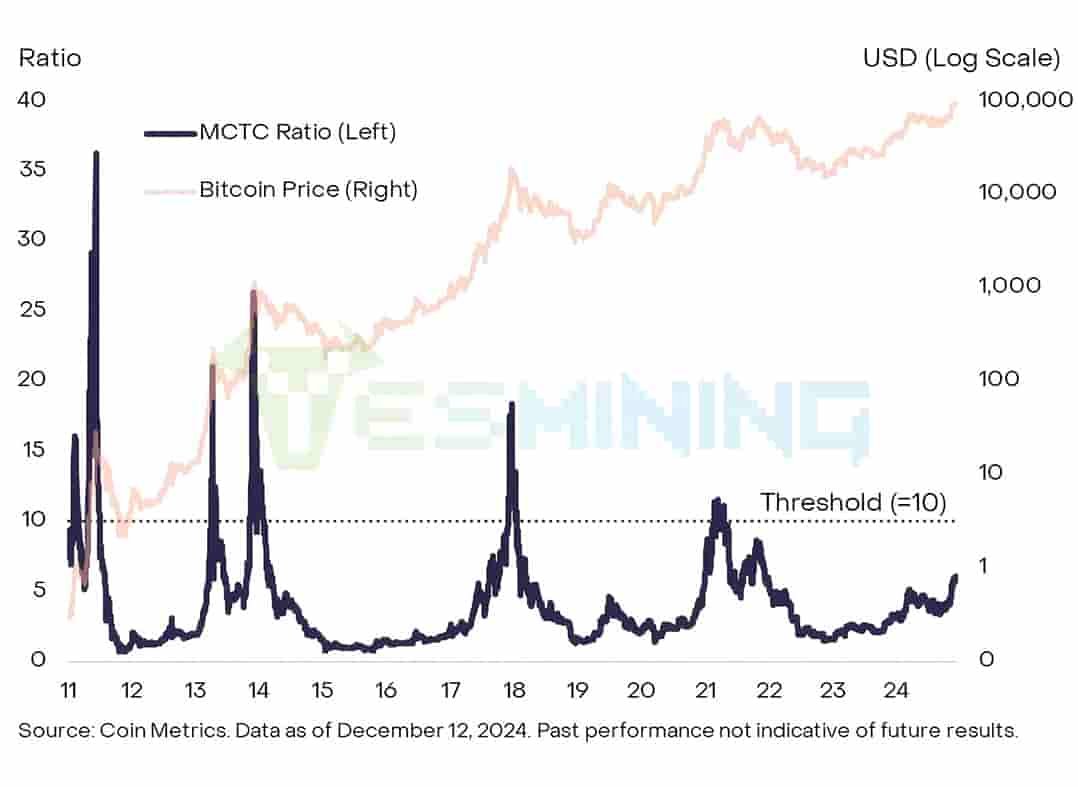

3,MCTC Ratio: The ratio of miner asset value to cumulative issuance value is currently around 6, suggesting there’s still room for growth compared to previous cycle peaks.

For crypto miners, keeping an eye on these indicators can offer valuable insights into the market’s trajectory, helping them to adjust their strategies and seize the opportunities of an ongoing bull market.

Bitcoin and Ethereum: Key Drivers of the Ongoing Crypto Bull Run

Grayscale’s report devotes special attention to the leading cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), as critical drivers of the market’s continued expansion.

Bitcoin, known as ‘digital gold,’ is the dominant asset in the cryptocurrency market and a reliable hedge against economic uncertainty. As the first and most well-established cryptocurrency, it continues to play a central role in driving capital flows across the entire market. In past bull market cycles, Bitcoin’s market dominance tends to peak around the second year of the bull market, a trend that is re-emerging, suggesting Bitcoin will maintain its leadership in terms of capital influx. With the launch of spot Bitcoin ETPs, institutional investment is expected to rise significantly, further boosting Bitcoin’s price and reinforcing its position at the forefront of the market. As Bitcoin demand continues to grow, mining operations are set to thrive, and using high-performance mining equipment will be key. Therefore, purchasing an ASIC miner is a wise investment. High-performance miners such as the ElphaPex DG Hydro 1, Antminer L9 Mix LTC+DOGE Miner, Volcminer D1, and ElphaPex DG1+ Miner can help miners capitalize on this surge in demand, ensuring they stay competitive and maximize their returns as we approach 2025. By broadening access to Bitcoin and Ethereum, these ETPs are expected to fuel demand and support higher valuations, further extending the bull market.

Meanwhile, Ethereum, the backbone of the blockchain ecosystem, continues to power smart contracts, decentralized applications (dApps), and ERC-20 tokens. Ongoing improvements, such as the transition to Ethereum 2.0, are enhancing scalability and efficiency, which will further drive its adoption.Together, Bitcoin and Ethereum are poised to play pivotal roles in extending the current bull run.

For miners, this continued growth in both Bitcoin and Ethereum presents opportunities to expand operations. By adjusting to the evolving market landscape, miners can not only support these networks but also potentially benefit from increased transaction volumes and higher cryptocurrency valuations.

Regulatory Developments and Institutional Support: Paving the Way for Crypto Growth

Grayscale anticipates that U.S. Congressional developments may lead to clearer regulations, which would have a positive impact on the cryptocurrency market. While regulatory uncertainty has historically been a key barrier to crypto adoption, increasing political support suggests that the regulatory landscape may soon shift toward digital assets, paving the way for greater growth and wider acceptance. In addition, the approval of Bitcoin and Ethereum ETPs has already brought in a substantial $36.7 billion in capital, which could continue to drive mainstream adoption of crypto assets. Ethereum, as the backbone of the blockchain ecosystem, powers smart contracts, decentralized applications (dApps), and ERC-20 tokens. With ongoing upgrades like the transition to Ethereum 2.0, its scalability and efficiency are set to improve further, accelerating its adoption.

An Optimistic Forecast for the Crypto Market’s Continuation

A cryptocurrency predictions report from Grayscale Research is optimistic about the outlook for the cryptocurrency market, predicting that while the four-year cycle may no longer be strictly applicable, the current mid-cycle phase suggests that the current bull market could continue into 2025 and beyond if fundamentals remain strong. Investors should keep an eye on blockchain indicators, market signals from alternative coins, and regulatory developments to assess the direction of the market and effectively manage risk. The changing nature of crypto markets suggests that the future may look different from past cycles, presenting both challenges and opportunities for investors.

For miners, the current market conditions, supported by strong fundamentals such as rising adoption, institutional interest, and regulatory developments, suggest a favorable environment for continued profitability.

Finally, Yesmining would like to remind everyone that all investments come with inherent risks, so it’s important to proceed with care. As a trusted global cryptocurrency mining and trading company, Yesmining offers a wide range of professional, timely, and affordable miner purchasing and hosting services aimed at maximizing your financial returns.