Blog

Is now a good time to start bitcoin mining, or does Bitcoin Volatility make it too risky? Many new crypto miners worry about price swings. These swings can change how much money they make very fast. Recent numbers show how quickly things can change:

Bitcoin’s volatility has gone down over time, but it is still much higher than gold or stocks.

Some years, bitcoin mining had big losses, but miners who waited often saw their money come back later.

Learning about these patterns helps people know when to start bitcoin mining. Timing is not just guessing the next price. People who look at market cycles and think about their own needs can find better chances in crypto mining.

Key Takeaways

Bitcoin mining can make money, but timing is important. Learn about market cycles instead of guessing prices.

Use automated mining plans to lower risks when prices change fast. These plans help keep your income steady and stop quick choices.

Watch important numbers like Bitcoin price, mining difficulty, and costs. These things affect how much money you make.

Pick the best mining way for your money and skill. Pool mining gives steady pay for new people. Solo mining needs more skill and tools.

Keep up with live market news and tools that track changes. This helps you choose when to start or stop mining.

Bitcoin Volatility: Opportunity or Risk?

How Volatility Creates Opportunities and Risks for New Miners

Bitcoin volatility changes things for new miners in many ways. When prices move quickly, miners can use automated mining strategies. These strategies use algorithms and cloud technology. They help miners earn steady money even when prices change a lot. Automation also helps stop mistakes from emotions. This planned way turns surprises into steady income for people who know market cycles.

But mining bitcoin when prices jump around has risks:

Bitcoin mining can make electricity costs change, so bills are hard to predict.

Using more energy for mining can hurt the environment with more carbon emissions.

Big price swings in bitcoin mining can change electricity prices, like during COVID-19.

Miners need to watch market trends and think about their own needs. It is best to start mining when they know market cycles, not just guess price highs or lows.

Main Drivers of Bitcoin Volatility

Many things make bitcoin prices change a lot today. These include:

Supply and demand make bitcoin rare and change prices.

News and events can make people buy or sell fast.

How much bitcoin is traded affects price moves when big trades happen.

New rules from governments can make prices go up or down.

Big world events and worries about inflation make people buy bitcoin.

Using borrowed money and trading tools can make price swings bigger.

Rules and new technology matter too. The table below shows how these things affect bitcoin price changes:

Evidence Type | Description |

|---|---|

Regulatory Impact | China’s ban on Bitcoin in 2021 made prices fall from about $64,000 to $48,000. |

Positive Regulation | People thought the SEC would approve Bitcoin ETFs, so prices went up in October 2023. |

Technological Developments | New things like the Lightning Network make bitcoin work better but can also cause new price jumps. |

Market trends, rules, and technology all affect bitcoin mining choices. Miners who learn about these things can make smarter decisions. They do not chase quick profits. They focus on making money over time in cryptocurrency.

Bitcoin Volatility and Mining Profitability

Price Swings and Profit Fluctuations

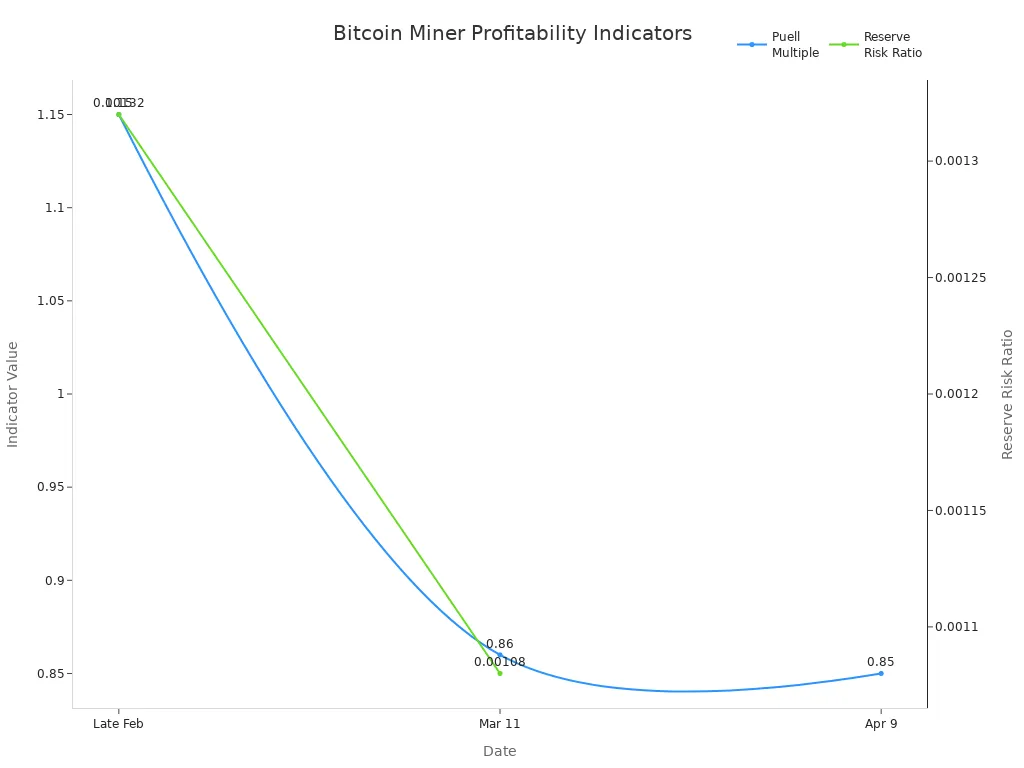

Bitcoin mining rewards can change fast when prices move. Both new and old miners see profits go up or down with each price swing. If the price drops, miners might have to sell bitcoin for less than they paid. Big mining companies often use futures contracts to help protect against price changes. The value of bitcoin decides how much money miners get. When the price goes up, miners earn more. If the price goes down, they make less. After halving events, miners sometimes stop making money and start losing it. The Puell Multiple helps miners know if they might lose money soon. In the past, when new bitcoin supply was cut, the price often went up. This helped miners get back some of their losses.

Hash Rate (TH/s) | Daily Revenue ($) | Daily Hash Price ($/TH) |

|---|---|---|

110 | 9.51 | 0.086 |

1 | 0.000001001663 | N/A |

Mining Difficulty and Network Effects

Mining difficulty changes about every two weeks. The bitcoin network changes difficulty based on how many miners there are. When more miners join, difficulty goes up. Miners then get fewer bitcoins for the same work. This can be hard for small miners. If difficulty goes down, miners spend less on computers and can earn more. How much miners get from rewards and transaction fees also changes their income. When prices move a lot, transaction fees can change quickly too. More miners fighting for rewards can make profits rise and fall. Energy costs and new rules can change how many miners stay in the market. Sometimes, lower fees mean the bitcoin network is less safe. If mining happens in only a few places or with special machines, centralization risks get bigger.

Tip: Miners should watch for changes in difficulty and network effects. These things can help them know when to start or stop mining.

Key Metrics to Gauge Your Entry Timing

People who want to know how much crypto miners make should watch key metrics before they start mining. Timing is more important than guessing the next price. Miners should look at market cycles and their own costs. The table below shows important things to watch:

Metric | Importance |

|---|---|

Shows how hard it is to mine bitcoin. Higher difficulty means lower chances of earning bitcoin. | |

Price of Bitcoin | Directly affects profits. Lower price can make mining unprofitable. |

Mining Operation Costs | Includes electricity and hardware costs. These are key for overall profitability. |

The hash rate and mining difficulty are linked to electricity costs. Lower electricity prices help miners earn more, which makes the hash rate go up. If electricity costs rise, some miners quit, and difficulty drops. When bitcoin’s price goes up, more miners join, so hash rate and difficulty rise. Miners should always check these numbers and think about their own situation. The best time to start mining is when people know market cycles and their own costs, not just when prices are high or low.

How to Mine Bitcoin: Methods

Solo Mining

Solo mining is when one person mines bitcoin alone. They use their own machines and pay for everything. This way, the miner controls the whole process. Solo miners want to keep all the rewards. They need strong computers and must buy expensive equipment. Solo miners compete with big mining farms. Their earnings can change a lot. High electricity bills can lower profits. Solo mining is best for people who know how to mine crypto and can pay high costs. When network difficulty is low, solo miners may have better luck.

Pool Mining

Pool mining lets many people work together to mine bitcoin. They share their machines and split the rewards. Pool mining helps miners get steady payouts. Miners can start with less money and weaker computers. They also share costs for repairs and electricity. Pool mining gives a regular income. When the pool finds a block, everyone gets a part of the reward. Pool mining makes it easier for people to learn how to mine crypto at home. Miners should watch market cycles and join pools when payouts are steady.

Comparison

Mining Type | Reward Consistency | Explanation |

|---|---|---|

Solo Mining | Unpredictable | Depends on luck and your own hash power, so rewards change a lot. |

Pool Mining | Steady |

Solo mining gives all the block rewards but can mean long waits for money. Pool mining pays out often, so it is easier to plan and buy new equipment. Miners should look at solo and pool mining to see what fits their needs. People who want to learn how to mine bitcoin or find good mining software should check both ways. Joining mining pools at the right time can help miners earn more. Learning how to mine crypto and watching market cycles helps miners make smart choices.

Tip: Miners should pick a way that fits their budget and risk level. Pool mining is good for beginners. Solo mining is better for people with strong machines and lots of experience.

Crypto Mining Hardware

Popular Devices

There are many top machines for bitcoin mining. ASIC miners are now the most used. They work better and make more money than old GPU or FPGA models. Some of the best bitcoin mining machines are:

The Antminer S21 Pro by Bitmain is very popular. It has a hash rate of 200TH/s.

The AvalonMiner 1246 from Canaan Creative has a hash rate of 90 TH/s.

More people are joining crypto mining, so ASIC miners are used even more.

These machines help miners keep up with bitcoin changes. Buying hardware at the right time can save money. It is smart to avoid buying when prices are highest.

Key Performance Parameters

When picking bitcoin mining hardware, some things matter most:

Hashing Power shows how fast a miner can solve problems and get rewards.

Energy Efficiency means using less electricity for the same work. This helps miners make more money.

Cost includes the price to buy and the money for power and repairs.

Durability means the hardware lasts longer without breaking. This is important for mining.

Manufacturer Reputation means trusted brands give better help and quality.

Miners who know these things can make better choices. They can also react faster when the market changes.

Cost vs. Efficiency

How much mining hardware costs and how well it works are both important. Good ASIC miners cost more at first but save money later. They use less power and work better. The table below shows some top machines:

| Model | Price | Hash Rate (TH/s) | Power Consumption (W) |

|---|---|---|---|

| Bitmain AntMiner S21 Pro | $4,500 | 234 | 3,510 |

| Bitmain AntMiner S21 XP Hydro | $7,500 | 473 | 5,676 |

| MicroBT Whatsminer M66S++ | $8,660 | 356 | 5,518 |

| Canaan Avalon Q | $5,500 | 210 | 2,835 |

| Bitmain AntMiner L9HU2 | $3,400 | 22 | 3,740 |

| Bitmain AntMiner L11HU6 | $17,000 | 33 | 5,676 |

Electricity prices can change how much money miners make. Many miners look for places with cheap power to earn more. Upgrading or buying new hardware at the right time helps miners save money. This also helps them make more profit as the bitcoin market changes.

Crypto Mining Hardware

Cooling and Maintenance

Electricity costs are very important in bitcoin mining. Miners need to watch how much they pay for power. Electricity prices are different in each place. This can change how much money miners make. The table below shows how electricity prices affect profits in different places:

Region | Average Electricity Price | Impact on Profitability |

|---|---|---|

USA | $0.10 per kWh | Higher costs reduce profits |

Kazakhstan | $0.03 per kWh | Low costs, but infrastructure challenges |

Russia | $0.05 per kWh | Relatively low cost |

Miners in places with cheap power can earn more money. Miners in places with expensive power may make less profit. People who want to start mining should check local electricity prices first. It is smart to start mining when power prices are low or steady. This helps miners keep more of their money.

Cooling is also very important for mining. Mining machines work hard and get hot. If miners do not cool their machines, they can break or slow down. There are different ways to cool mining machines. Each way has good and bad points.

Cooling Method | Pros | Cons |

|---|---|---|

Air Cooling | Cost-effective, easy maintenance, widely available | Limited efficiency, limited scalability, noise |

Immersion Cooling | Efficient heat dissipation, high-density setups, reduced dust | Initial investment, complex maintenance, limited compatibility |

Good temperature control, scalability, lower energy costs | Infrastructure needs, maintenance challenges, limited systems available |

Air cooling uses fans and vents to blow heat away. It works well in cool places and costs less.

Immersion cooling puts machines in special liquid. The liquid takes heat away fast and keeps dust away.

Hydro cooling uses water to move heat away from machines. It controls temperature well and can save energy.

Miners should choose a cooling method that fits their setup and budget. Good cooling helps machines last longer and work better. Timing matters too. Upgrading cooling before hot weather or when growing bigger can stop losses.

Regular maintenance is just as important as cooling. Cleaning, updating software, and checking for problems help machines run well. These steps stop small problems from becoming big ones. Miners who care for their machines avoid costly downtime. They keep their mining running smoothly.

Doing regular maintenance helps miners in the long run. It protects the money spent on machines and helps them work better. Miners who focus on maintenance can stay in mining longer. They have a better chance to make steady profits, even if bitcoin prices change.

Note: Smart miners plan when to start mining by looking at electricity costs, cooling needs, and maintenance. They do not just chase high prices. They make choices based on their own needs and the market cycle.

Essential Tools and Resources for Bitcoin Mining

Volatility Tracking Solutions

Miners need to watch bitcoin price changes to make smart choices. Volatility tracking tools help miners see market moves and risks. These tools show patterns, so miners know when to start or stop mining. Using volatility analysis helps miners think about more than just making money. Miners learn to choose based on market cycles and their own needs. Some tools let miners set automatic trades, like stop-loss and take-profit orders. These features help miners control risk by selling or buying at certain prices. Position-sizing calculators help miners pick how much to invest in crypto mining. Risk-reward ratio tools show possible gains and losses. This makes it easier to pick the best time to start mining.

Automated trading features help miners avoid big losses.

Position-sizing calculators lower the risk of losing too much money.

Risk-reward ratio tools help miners see if the reward is worth the risk.

Timing is very important. Miners who use these tools can make better choices by watching market cycles instead of guessing highs or lows.

Profitability Assessment Tools

Profitability calculators help miners see if bitcoin mining will make money. These tools use numbers like hash rate, power use, and electricity cost. Miners can check daily, weekly, or monthly profits for bitcoin and other coins. Some tools show hardware efficiency and switch coins for better returns. Miners should remember calculators give estimates, not promises. Market changes, hardware efficiency, and electricity costs can change real profits.

Tool | Key Features |

|---|---|

What To Mine | Supports many GPUs and ASICs, inputs for hash rate and power, shows profits for different coins. |

NiceHash | Easy to use, shows hardware stats, auto-detects GPUs, works with NiceHash software. |

Minerstat | Gets real-time data from mining pools, switches coins for best profit, works for GPU and ASIC. |

Other helpful features include:

Temperature and fan speed monitoring

Profitability calculators

Security features like encryption and two-factor authentication

Community support and updates

Miners should check these tools often and use them to plan when to start bitcoin mining based on market cycles.

Real-Time Market and Network Information

Miners need real-time info to make good choices in bitcoin mining. Trusted sources give data on bitcoin prices, network activity, and market trends. These sources help miners see when the market is changing and change their mining plans. APIs and websites give up-to-date stats, block data, and transaction details. Miners use this info to track market cycles and decide when to start or stop mining.

Source | Description |

|---|---|

Blockstream API | Real-time and historical bitcoin data, including transactions and blocks. |

Blockchain.com API | Live stats, wallet info, and transaction data. |

BitcoinAverage API | Weighted average bitcoin price and historical data. |

Token Metrics API | Market data for bitcoin, both real-time and historical. |

CoinGecko API | Current prices, volume, and market cap. |

Nomics API | Transparent trade data for bitcoin prices. |

CoinMarketCap API | Tracks bitcoin price, market cap, and trading volume. |

Glassnode API | On-chain metrics for supply, demand, and investor behavior. |

Messari API | Historical price and on-chain metrics for market research. |

Blockchair API | Analysis of transactions and block data. |

Mempool.Space API | Real-time data on unconfirmed bitcoin transactions. |

Tip: Miners who use these resources can spot market cycles and make better choices about when to start or stop bitcoin mining. They do not need to guess highs or lows. They focus on timing their entry using good market data and their own needs.

Bitcoin mining works best when you pick the right time. You should not just guess when prices are high. Volatility can make profits change fast. Miners need to plan and manage risks well. They can use special ways to protect their money. Some ways are revenue locking, using derivatives, and selling on the spot market:

Strategy Type | Description |

|---|---|

Revenue Locking | Lock in money to pay costs and keep things steady. |

Derivatives Usage | Use futures or options to protect against price changes. |

Spot Market Sales | Sell some bitcoin to get regular cash. |

Miners should look at hash rate trends and moving averages. These help find good times to start mining. Before mining, miners need to check their money, goals, and skills. Watching things in real time and using new tech helps miners work better. Picking the right time by knowing market cycles and personal needs gives miners the best chance for steady profits.

FAQ

What is the best time to start bitcoin mining?

People should learn about market cycles and their costs first. It is better to plan than guess when bitcoin prices will peak. Miners who watch trends and make a plan can earn steady money.

How does bitcoin volatility affect mining profits?

Bitcoin volatility makes mining profits change fast. When prices go up, miners earn more money. If prices drop, profits get smaller. Miners who know market cycles and change their plans can lower risks.

Do electricity costs impact bitcoin mining?

Electricity costs can change how much miners earn. Miners in places with cheap power make more money. People should look at local electricity prices before they start mining. Starting when costs are low helps miners keep more profit.

Is solo mining better than pool mining for beginners?

Pool mining is good for beginners because payouts are steady. Solo mining needs strong computers and more skill. People should pick based on their budget and how much risk they want. Starting when the market is stable helps both solo and pool miners.

What tools help miners track bitcoin market cycles?

Miners use special tools to watch bitcoin price changes and profits. Real-time data helps miners know when to start or stop mining. These tools help miners make smart choices and time their entry better.